- European Markets Regulator Targets Greenwashing, Transparency in New Sustainable Finance Roadmap

- DTCC Launches Treasury Service Providing Access to Repo Trade Data amid Market Uncertainty

- India Expected to Go Live on T+1 from 25 February

- Proxymity Collaborates with Computershare on US Vote Confirmation Pilot

European Markets Regulator Targets Greenwashing, Transparency in New Sustainable Finance Roadmap

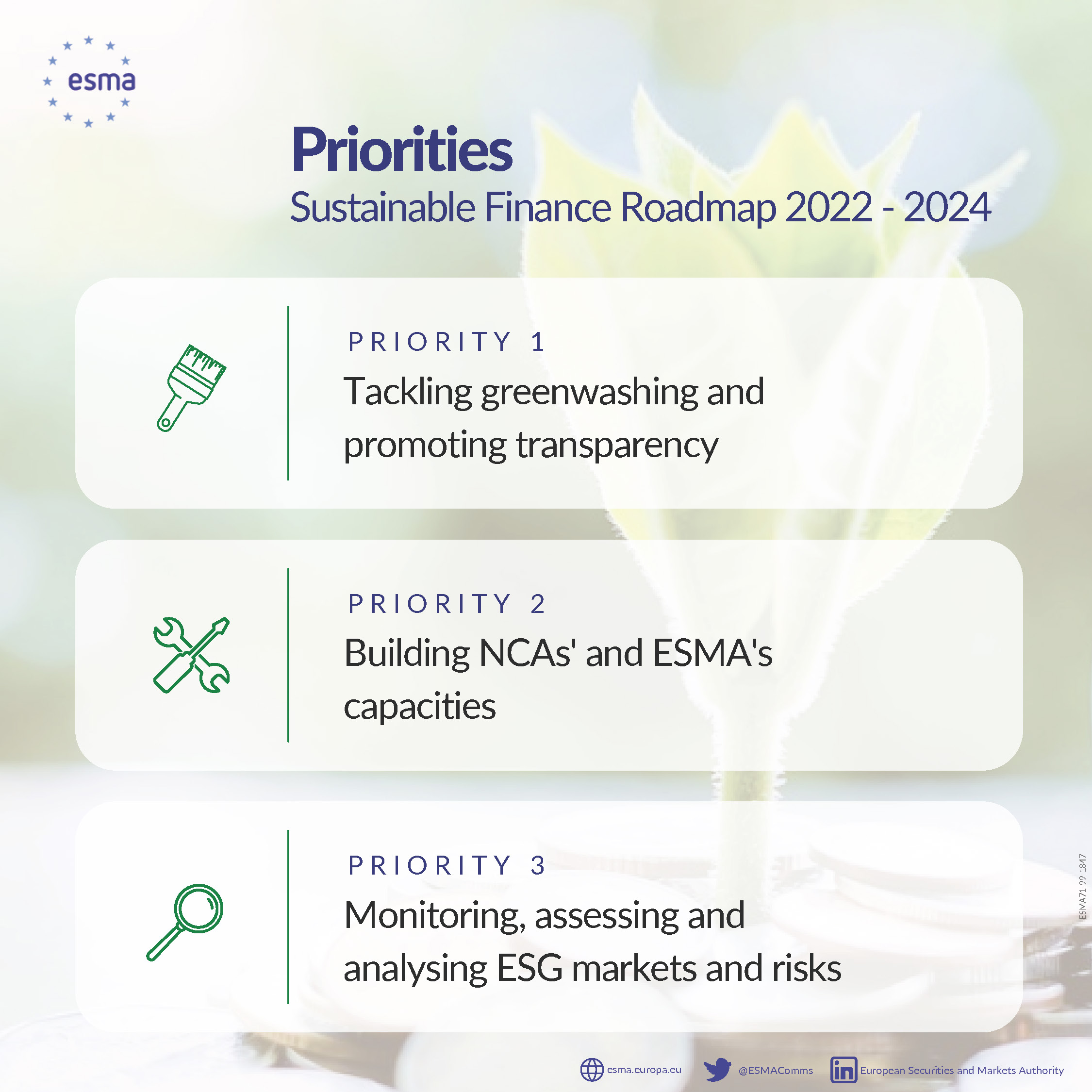

EU markets regulator the European Securities and Markets Authority (ESMA) announced today the release of its new Sustainable Finance Roadmap, setting out its priority areas for action and implementation deliverables to address the rapidly emerging and evolving sustainable finance market over the next three years.

As major global economies look to transition to a low-carbon and sustainable economy, a major role has emerged for financial markets to promote and support the massive capital flows and investments necessary to facilitate this change. The sustainable finance market has grown and evolved rapidly, as investors and financiers increasingly channel capital to participate in the opportunities created by these disruptive forces and new investment products become available, challenging regulators to fulfill their roles of protecting investors and maintaining market stability.

Verena Ross, Chair, said:

“Advancing the sustainability agenda is crucial for ESMA, particularly as investor preferences shift to environmentally friendly financial products and the European Union strives to meet its commitments on tackling climate change.”

One of the key challenges for regulators, and a top priority area for ESMA’s new roadmap, is addressing the risk of greenwashing, referring to situations in which the claims made regarding the sustainability profile of an issuer or a financial instrument are misleading or misrepresented. ESMA notes that greenwashing can either be intentional or unintentional as a result of regulatory differences or poor data quality. The new roadmap outlines ESMA’s strategy to investigate, better define, address and help find common EU-wide solutions for greenwashing.

Other top priority areas in the new roadmap include building capacities in sustainable finance for ESMA and for national competent authorities (national-level regulatory authorities, or NCAs), and monitoring, assessing and analysing ESG markets and risks. Efforts here will include instituting sustainable finance training programs for ESMA and NCA staff, developing climate scenario analysis and stress testing, along with enhanced common risk analysis methodologies.

The roadmap sets out a broad range of action areas aimed at addressing its key defined priorities, ranging from reviewing SFDR disclosure requirements, implementing requirements for the design of ESG investment products and contributing to the development of sustainability reporting standards for issuers to improving the comparability and reliability of ESG ratings and monitoring carbon markets.

Ross added:

“The Roadmap is a milestone for our sustainable finance work, identifying the priority work we will do to ensure that ESMA and national supervisors take ambitious action on priority sustainable finance issues.”

DTCC Launches Treasury Service Providing Access to Repo Trade Data amid Market Uncertainty

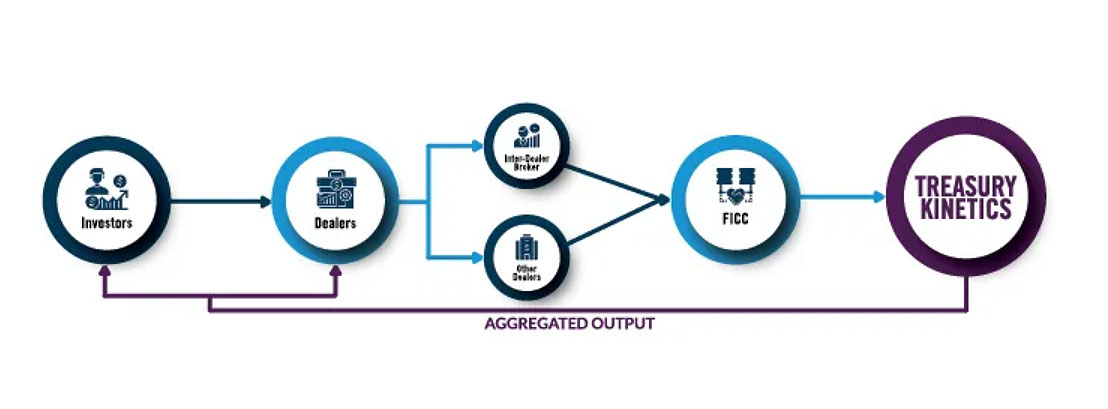

The Depository Trust & Clearing Corporation (DTCC) has launched a treasury kinetics service that provides access to US treasury transaction data in a bid to increase transparency into the repo market.

Leveraging data from the Government Securities Division of DTCC’s subsidiary, Fixed Income Clearing Corporation (FICC), the new service provides a daily summary of aggregated and anonymised trade activity including number of trades, volumes, dollar amounts and rates for delivery vs. payment (DVP) repo.

The DTCC said that, on average, FICC matches, nets and settles repo transactions valued at more than $3 trillion dollars each day.

As the repo market continues to evolve and grow, increased volatility in this sector has underscored the need for market participants to have access to data that enables them to better understand valuation, rates, and liquidity. Treasury Kinetics provides historical data dating back to 2011, allowing users to back-test current repo data against historical events.

The data set will provide market participants with a wide range of capabilities, including the ability to track stability, spot potential market dislocations, or search for the next investment opportunity, the DTCC said.

“This new service meets a critical industry need: access to a single, comprehensive data source that provides greater insight into the US repo markets,” said Tim Lind, managing director of DTCC Data Services. “DTCC Treasury Kinetics delivers one of the most comprehensive views of the repo markets available today, providing increased transparency for investors and intermediaries.”

DTCC is working to expand access to its DTCC Treasury Kinetics and other data services products by making them available on cloud-based marketplaces, beginning with Snowflake Data Marketplace, which is expected to be launched in the first quarter of 2022.

India Expected to Go Live on T+1 from 25 February

In September, the Securities and Exchange Board of India authorised plans for India’s two largest stock exchanges, the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), to shorten their settlement cycle for listed equities to T+1 on a phased approach beginning on 25 February 2022.

The initiative would see India become the first market to accelerate its equities settlement cycle from T+2 to T+1.

In support of the anticipated accelerated market timelines, The Depository Trust & Clearing Corporation (DTCC), who have been integral to moving the US equities markets to T+1, is working with India’s T+1 Industry Working Group (IWG) to promote broader adoption of its institutional trade processing's settlements management notifications functionality.

DTCC’s platform accelerates the process of communicating the matched economic details of a trade to local custodians throughout the trading day without having to wait till the close of trading.

In December 2021, DTCC released a report predicting that US securities are likely to move to next-day settlement during the first half of 2024.

In the report, DTCC, the Investment Company Institute and the Securities Industry and Financial Markets Association predicted that a transition from T+2 to T+1 settlement for the US in H1 2024 will give impacted firms sufficient time to assess the changes required, to conduct testing and for financial supervisors to implement the necessary regulatory amendments.

This will deliver T+1 settlement for US securities slightly less than a quarter of a century after moves to deliver this reduced settlement cycle, led by the Securities Industry Association, were “postponed” in July 2002.

Proxymity Collaborates with Computershare on US Vote Confirmation Pilot

Global transfer agent Computershare is working on a pilot programme with Proxymity and a select group of issuers, custodians and institutional investors to simulate how end-to-end vote confirmations improve communications and transparency in the voting process for all.

The pilot is one of two that Computershare has confirmed its support for, with the other an industry-led pilot intended to deliver end-to-end vote confirmations during the AGMs of Fortune 500 companies this spring.

The pilot follows extensive discussions and cooperation between transfer agents and other members of the SEC-initiated industry working group on implementing end-to-end vote confirmation, which is led jointly by the Society of Corporate Governance and the Council of Institutional Investors.

The aim is to achieve the dual purpose of improving transparency of voting for investors and issuers, while increasing confidence in the beneficial shareholder voting process.

Computershare said that extending confirmations more broadly across the industry will provide beneficial shareholders with proof that their votes were cast at the AGM in accordance with their instructions or rejected by the tabulator because of an irregularity.

As part of the overall Fortune 500 pilot programme, industry parties have also agreed to conduct an early-stage entitlement reconciliation pilot, enabling brokers to compare their records with a tabulator before the proxy vote.

Participating banks and brokers will seek to reconcile their investor clients’ aggregate voting positions to discrete voting entitlements that may be reflected directly and indirectly in the tabulator’s voting register.

This sub-pilot is being conducted with 20 companies during the 2022 AGM season.

Computershare noted that without a semi or fully automated solution for early-stage entitlement transfers, a significant administrative burden would likely shift to the vote tabulators and their issuer clients.

"We look forward to taking part in both pilots and will continue to push for positive improvements to the overall voting system, including the development of an automated, systematic approach to confirm changes to bank and broker voting entitlements after the record date for voting," said Paul Conn, president of global capital markets at Computershare.