To enable asset management providers in Taiwan to tailor services to investors’ requirements, design new products to fits their needs, and elevate marketing and business operation efficiency,Securities & Futures Institute conducted the “2021 Survey of Fund Investors’ Investment Behavior and Preferences.”

The survey retrieved 4,096 effective samples. To observe fund investors’ behavior models and preferences, we calculated their responses and categorized investors based on their basic information. Overall, most survey results are not so much different from ordinary circumstances, but some may be surprising. Based on investors’ monthly income levels, this research will explore some surprising results from the survey.

I.Low-income earners have less money to manage. Do they have less need for investment consulting services?

“High-income earners pursue asset appreciation; they even have to consider taxation planning, so they need professional assistance and planning more. People of lower-income levels don’t have much to invest, so why do they need consulting services?”

Nevertheless, the survey has found that low-income earners have the strongest need for financial consultation. What’s more, a hefty 40% of those whose monthly income is less than NT$20,000 indicate they need advice from financial consultants, and this ratio declines as the income level rises. This downward trend isn’t reversed until the monthly income reaches NT$80,000 to NT$100,000. Of course, earners with higher income indeed have more substantial needs to manage their finances; on the other hand, low-income earners are most dependent on financial consultants due to their low financial literacy or insufficient investment experience.

Source: Securities & Futures Institute, 2021 Survey of Fund Investors’ Investment Behavior and Preferences

II. Low-income earners’ time cost is lower. If the investment cost is low, does it matter to spend more time?

“Many people are willing to spend time standing in line at midnight for NT$1 tea eggs and yogurt drinks. Therefore, as long as the cost is low, isn’t it OK to spend more time on self-study and investment?”

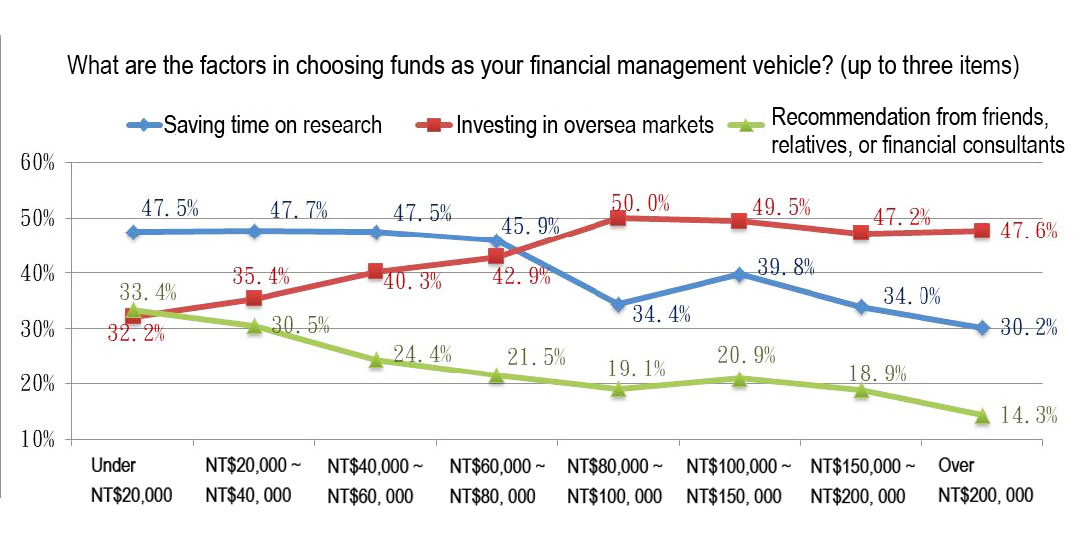

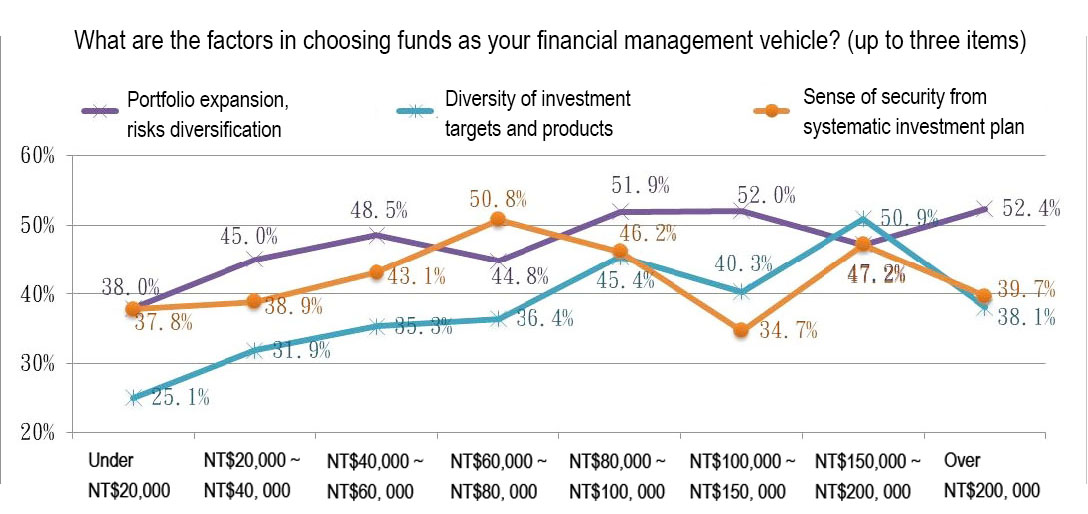

However, after we analyze why investors with different income levels choose funds as their investment vehicle, the result shows that a higher ratio of low-income earners choose funds as their investment vehicle to “save time on research,” and about 48% of people with monthly income under NT$60,000 also choose this reason. Considering the amount that low-income earners invest is usually smaller, even self-studying might help them find lower rate funds, the total amount they can save won’t be too high. On the other hand, low-income earners’ time on investment research is not less than high-income earners’. This provides even less drive for them to invest independently.

In addition, as mentioned above, low-income earners are also more reliant on others’ advice. If relatives, friends, or financial consultants recommend some mutual funds, low-income earners are more willing to embrace funds as their investment vehicle. In contrast, high-income earners focus more on the merits such as “investing in overseas markets,” “portfolio expansion, risks diversification,” and “diversity of investment targets and products,” with 47.6%, 52.4%, and 38.1% of those who earn over NT$200,000 monthly prioritizing these factors respectively. By contrast, only 32.2%, 38%, and 25.1% of earners with monthly income under NT$20,000 prioritize these factors respectively.

Source: Securities & Futures Institute, 2021 Survey of Fund Investors’ Investment Behavior and Preferences

I.Low-income earners have less money to manage. Do they have less need for investment consulting services?

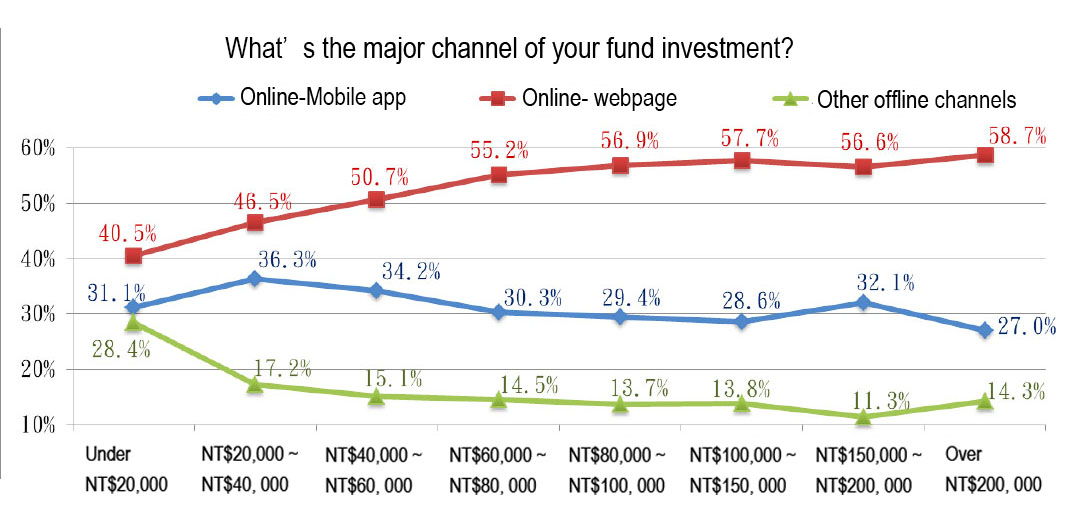

“People with high income can enjoy various privileges at banks from financial consultants, so are those using online channels low-income nobodies?”

After analyzing major fund subscription channels used by earners with different income levels, we find that a more significant percentage of earners of higher income levels invest through “Online-webpage,” and a smaller percentage of them do so through “other offline channels (mainly through over-the-counter services).” A massive 58.7% of earners with a monthly income of over NT$200,000 mainly subscribe to mutual funds through online-webpage, and only 14.3% of them do so through offline channels. In contrast, 40.5% of people earning under NT$20,000 a month invest in funds through online-webpage, while 28.4% do so through offline channels.

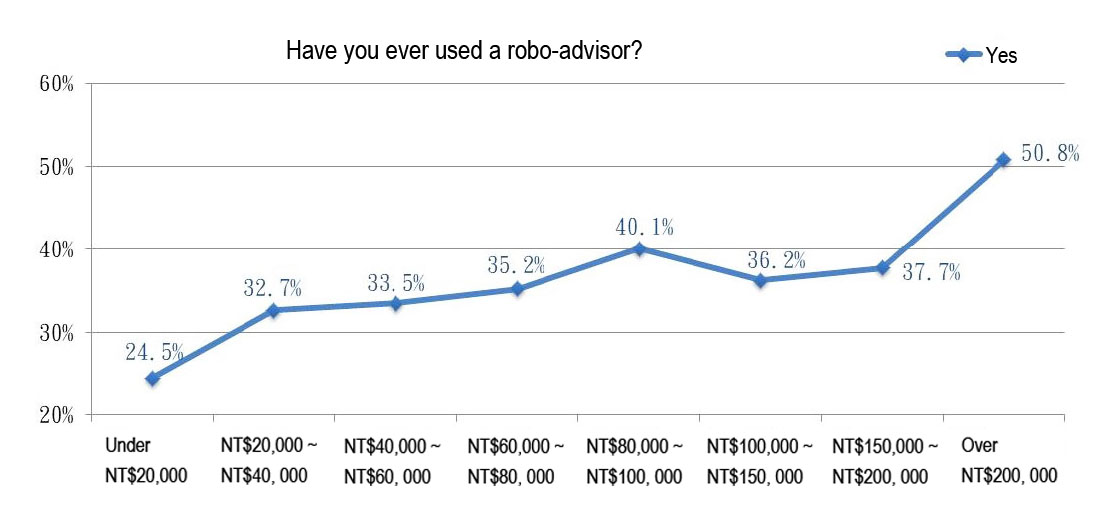

Besides, although robo-advisors are usually regarded as available financial access for those who can’t afford financial consulting services, the survey results show the highest proportion of the robo-advisor experience is from high-income earners, with 50.8% of people earning NT$200,000-above a month reporting having this experience. In comparison, only 24.5% of those with monthly income of under NT$20,000 have used a robo-advisor.

Source: Securities & Futures Institute, 2021 Survey of Fund Investors’ Investment Behavior and Preferences

IV. Are low-income earners are more willing to take risks to strike it rich? Do high-income earners prefer stable fund dividends?

“If there’s a huge amount of wealth, it’s enough to invest it in bond funds and receive the monthly dividends. If the amount of capital is small, a more aggressive investment strategy should be adopted. Otherwise, how on earth can there be enough money?”

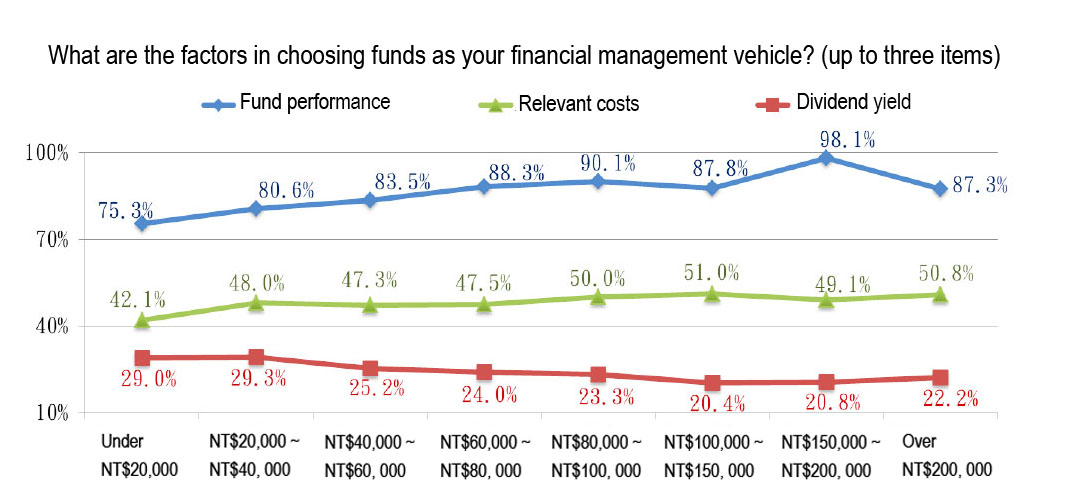

Some low-income earners might have the perspective mentioned above, but such aggressive investors may not choose mutual fund as their investment vehicle. The findings of this survey indicate that the major consideration of fund investors of different income levels lies in performance. However, a higher percentage of high-income earners put a relatively heavier emphasis on performance, with about 90% of people earning over NT$60,000 a month taking performance as the priority. On the contrary, 75% of those with monthly income under NT$20,000 prioritize performance.

Furthermore, high-income earners also put more emphasis on relevant costs of fund subscription. 50.8% of people making over NT$200,000 a month and a mere 42.1% of those who earn NT$20,000 a month do so. As for the proportion of prioritizing dividend yield, there’s a lower proportion of monthly NT$100,000-above earners, between 20.4% and 22.2%, and a more significant proportion of 29% earners with monthly income under NT$40,000.

Source: Securities & Futures Institute, 2021 survey of fund investors’ investment behavior and preferences

Summary

The explanations above only cover some exceptional circumstances from this survey. In addition to monthly income, there are other causes for investors’ different fund investment behavior, such as age and gender, and these traits mutually affect one another. Through the empirical research of “2021 Survey of Fund Investors’ Investment Behavior and Preferences,”we have more opportunities to analyze fund investors’ behavior objectively.

In addition, this survey can serve as a reminder that some investors are still faced with the difficulties of lacking relevant experience and financial literacy. They need assistance, but they may neither be entitled to exclusive services nor understand how to use a robo-advisor. Hence, besides focusing on professional training, promoting financial literacy to the general public is also the objective to strive for in the future.